Energy Trading and Risk Management Market Size, Share, Overview, Key Players, Regional Analysis & Industry Report 2032

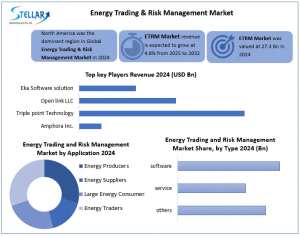

Energy Trading and Risk Management Market was valued at USD 27.3 Bn in 2024 to grow at a CAGR of 4.8% from 2025 to 2032, reaching nearly USD 39.7 Bn by 2032.

Energy Trading and Risk Management Market is set to surge with AI-driven ETRM solutions, blockchain innovation, and renewable integration, unlocking profitable, compliant, and agile global”

SAN DIEGO, CA, UNITED STATES, October 3, 2025 /EINPresswire.com/ -- The Energy Trading and Risk Management Market is set for rapid growth, rising from USD 27.3 Bn in 2024 to USD 39.7 Bn by 2032. Uncover key trends, AI-driven ETRM solutions, risk management strategies, and emerging opportunities shaping global energy trading and market expansion— Dharati Raut

Energy Trading and Risk Management Market Overview:

Energy Trading and Risk Management Market is witnessing explosive growth, set to rise from USD 27.3 Bn in 2024 to USD 39.7 Bn by 2032. Fueled by energy price volatility, renewable adoption, and geopolitical shifts, advanced AI-, ML-, and blockchain-powered ETRM solutions are transforming trading, forecasting, and risk management. North America leads, Asia Pacific surges, and strategic acquisitions are reshaping profitability, compliance, and market leadership.

Energy Trading and Risk Management Market: Advanced ETRM Software Driving Rapid Growth

Energy Trading and Risk Management Market is surging as energy price volatility hits unprecedented levels. Geopolitical stress, natural disasters, and shifting supply-demand dynamics are pushing firms to adopt advanced ETRM solutions. Powered by AI, machine learning, and blockchain, these systems help energy companies predict market swings, optimize trading strategies, and manage risks, unlocking transformative opportunities in energy risk management. Explore how cutting-edge ETRM software is redefining trading, compliance, and profitability in today’s dynamic energy markets.

👉 Access the full Research Description at: https://www.stellarmr.com/report/req_sample/energy-trading-risk-management-market/2830

Transforming Energy Trading: Adaptive ETRM Software, AI, and Cloud Solutions Unlock New Opportunities

The Energy Trading and Risk Management Market is seizing new opportunities as digital transformation accelerates. Cloud-based ETRM solutions, AI, and machine learning are enabling real-time decision-making, optimized trading strategies, and smarter risk management. As businesses embrace digitization, adaptive ETRM software is becoming essential for faster, precise, and profitable energy trading, unlocking the next frontier in energy risk management.

Energy Trading and Risk Management Market: Overcoming Volatility and Risk with AI-Driven ETRM Solutions

Energy Trading and Risk Management Market faces mounting challenges as price volatility, geopolitical stress, and shifting regulations disrupt energy trading. Unmanaged risks can lead to significant financial losses, making robust ETRM solutions essential. Leveraging AI and machine learning, companies can strengthen risk management, optimize trading strategies, and navigate uncertainty with confidence.

Energy Trading and Risk Management Market: How AI-Powered ETRM Services and Front-Office Operations Are Driving Profit and Mitigating Risk

Energy Trading and Risk Management Market thrives across software, services, and operational segments, with services leading market share in 2024. Specialized ETRM solutions, covering consultation, implementation, cloud migration, and cybersecurity, enable companies to navigate complex energy markets, maintain compliance, and stay competitive. Power trading dominates applications, while front-office operations drive profitability through price discovery, position management, and deal capture. Leveraging AI and advanced analytics, businesses are optimizing trading strategies, mitigating risks, and unlocking unprecedented opportunities in energy risk management.

Key Trends Shaping the Energy Trading and Risk Management Market: AI-Driven ETRM and Blockchain Empower Renewables and Smart Trading

Growing adoption of renewables like solar and wind is increasing electricity market complexity, driving demand for advanced ETRM solutions. AI-powered systems optimize supply variability, forecast generation, and enhance grid stability.

Blockchain boosts the Energy Trading and Risk Management Market by enabling secure, transparent peer-to-peer trading and efficient carbon offset tracking.

Key Developments in the Energy Trading and Risk Management Market: Strategic Acquisitions Driving ETRM Adoption, Digital Transformation, and Commodity Market Growth

In April 2024, Symphony Technology Group acquired Eka Software Solutions to strengthen its presence in commodity markets. Europe, driven by EMIR and MiFID II regulations, sees high ETRM adoption for compliant, transparent energy trading.

In March 2024, Sapient acquired Spinnaker SCA to enhance its supply chain services and accelerate digital transformation. This move strengthens operational efficiency and supports advanced ETRM solutions in energy and commodity markets.

👉 Access the full Research Description at: https://www.stellarmr.com/report/req_sample/energy-trading-risk-management-market/2830

Energy Trading and Risk Management Market: North America Leads While Asia Pacific Emerges as a High-Growth Hub Amid Volatile Energy Prices

North America leads the Energy Trading and Risk Management Market, driven by U.S. shale gas success and volatile energy markets. Asia Pacific is poised for rapid growth, fueled by rising ETRM adoption, evolving regulatory mandates, and surging energy demand in China and India, creating lucrative opportunities for advanced energy trading solutions. Overall, global market dynamics, including volatile energy prices and economic prosperity, are shaping the next wave of strategic growth in the ETRM sector.

Global Energy Trading and Risk Management Market: Strategic Insights, Trends, and Growth Opportunities for Decision-Makers

This report delivers a comprehensive analysis of the Global Energy Trading and Risk Management Market, covering all key stakeholders, from market leaders to new entrants. By simplifying complex data, it highlights current trends, forecasted growth, and strategic insights. Leveraging PORTER, SVOR, and PESTEL analyses, the report evaluates internal and external factors shaping the market, offering decision-makers a clear, forward-looking roadmap to capitalize on emerging opportunities in energy trading and risk management.

Energy Trading and Risk Management Market Key Players

North America

Allegro Development Corporation (USA)

Amphora Inc. (USA)

Triple Point Technology Inc. (USA)

Openlink LLC (USA)

Sapient (USA)

Ventyx (USA)

FIS (USA)

MCG Energy Solutions, LLC (USA)

Enuit LLC (USA)

Contigo (USA)

IGNITE CTRM (USA)

Molecule Software (USA)

Europe

Trayport (United Kingdom)

Brady Technologies (United Kingdom)

Calvus (Germany)

ComFin Software (Germany)

SAP (Germany)

ABB (Switzerland)

Accenture (Dublin, Ireland)

Asia -Pacific

Eka Software Solutions (India)

Analyst Perspective:

The Energy Trading and Risk Management (ETRM) Market is accelerating, driven by energy price volatility, geopolitical tensions, and renewable adoption. Advanced AI-, ML-, and blockchain-powered ETRM solutions optimize trading, forecast supply, and enhance grid stability. North America leads, while Asia Pacific emerges as a high-growth hub. Strategic acquisitions like Symphony Technology Group–Eka and Sapient–Spinnaker highlight competitive expansion. Companies leveraging adaptive ETRM platforms gain profitability, compliance, and strategic advantage in global energy trading.

FAQ

Why is this Energy Trading and Risk Management Market report important?

This report provides critical insights into global ETRM trends, AI-driven solutions, and market growth, enabling stakeholders to make informed strategic decisions.

How can businesses leverage this report?

Companies can identify emerging opportunities, optimize trading strategies, and stay competitive with insights on AI-, ML-, and blockchain-powered ETRM solutions.

Which regions offer the highest growth potential?

North America leads due to shale gas success, while Asia Pacific shows rapid growth driven by rising ETRM adoption and evolving regulatory mandates.

Maximize Market Research is launching a subscription model for data and analysis in the

Dental Materials market

https://www.mmrstatistics.com/markets/316/energy-and-power

Related Reports:

Angel Funds Market: https://www.stellarmr.com/report/angel-funds-market/2819

Debt Recovery Services Market: https://www.stellarmr.com/report/debt-recovery-services-market/2816

Credit Scoring Market: https://www.stellarmr.com/report/credit-scoring-market/2809

Prompt Engineering Market: https://www.stellarmr.com/report/Prompt-Engineering-Market/2801

Capital Expenditure Market: https://www.stellarmr.com/report/Capital-Expenditure-Market/2797

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Lumawant Godage

Stellar Market Research

+ +91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.