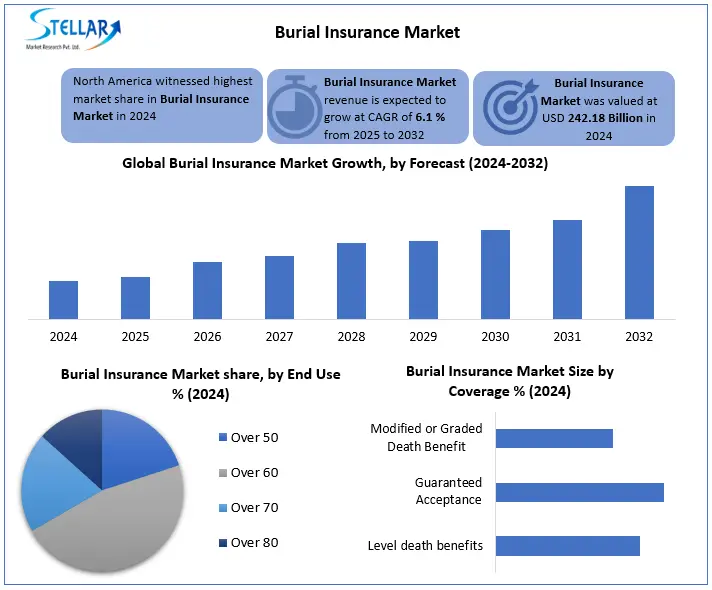

Burial Insurance Market to Hit USD 388.92 Billion by 2032 | Who Will Lead Global Growth, Trends & Innovation 2025–2032.

Burial Insurance Market revenue is expected to grow by CAGR 6.1% from 2025 to 2032 and reach nearly USD 388.92 Billion in 2032.

The Burial Insurance Market is undergoing a remarkable shift, blending digital innovation, AI-driven personalization, and compassionate care. Rising funeral costs”

WILMINGTON, DE, UNITED STATES, September 16, 2025 /EINPresswire.com/ -- Burial Insurance Market size valued at USD 242.18 Billion in 2024, projected to reach USD 388.92 Billion by 2032 at 6.1% CAGR. Explore global industry trends, growth drivers, key players, and forecast insights for 2025–2032.— Navneet Kaur

Stellar Reports provides this outlook on the Global Burial Insurance Market, where digital speed, AI-driven personalization, and compassionate community care are transforming how families plan with peace of mind. With costs rising, trust shifting, and new leaders emerging, the question is, who will shape the future of this vital market?

“The Digital Shift: Can Insurance Platforms Transform How Families Secure Peace of Mind?”

Digital platforms are transforming the Burial Insurance Market, delivering instant quotes, quick applications, and approvals in minutes. Tech-savvy consumers are drawn to the speed, clarity, and digital convenience, while AI tools and reviews empower confident, compassionate decisions. More than streamlining insurance, these platforms are redefining how families secure peace of mind. And if this is just the beginning, what breakthrough could reshape the market next?

👉 Access the full Research Description at: https://www.stellarmr.com/report/req_sample/burial-insurance-market/2804

“The Untapped Frontier: Can Burial Insurance Bridge the Rural and Low-Income Gap?”

Rural and low-income families remain largely underserved in the Burial Insurance Market, facing high costs with little coverage. Affordable, simplified plans, backed by outreach, mobile enrollment, and digital access, could unlock strong demand while delivering peace of mind. The real question is: who will lead in turning this gap into growth?

“Breaking Barriers: Can Burial Insurance Win Back Trust and Awareness?”

Many low-income and elderly consumers remain unaware that burial insurance is an affordable alternative to costly life policies. Mistrust, driven by hidden fees and confusing terms, keeps them from committing. Limited financial literacy deepens hesitation, slowing market growth. But within this challenge lies an untapped opportunity: who will build trust and capture the demand?

“Shifting Choices: Who Will Lead as Seniors Redefine Burial Insurance Demand?”

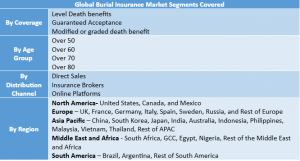

In the Burial Insurance Market, guaranteed acceptance policies dominate coverage, appealing strongly to seniors and individuals with health conditions as global funeral costs climb. On the distribution side, insurance brokers hold the largest share, with more than 55% of adults over 60 trusting their guidance to navigate complex choices. By age group, 50+, 60+, 70+, and 80+, the trend is unmistakable: longer lifespans are driving urgent demand for reliable, accessible coverage. The real question is, who will adapt fastest to serve this expanding wave of aging customers?

Burial Insurance Market Key Trends:

Impact of inflation: With funeral costs rising faster than general inflation, affordable burial insurance is becoming vital to help families manage end-of-life expenses with dignity and security.

Data analytics and AI: Insurers are embracing advanced analytics and AI to better understand individual needs, assess risk with precision, and deliver fair, personalized policy pricing, enhancing both customer trust and competitive edge.

“Burial Insurance Leaders Redefine Coverage with Digital Speed, Family-Centered Access, and Compassionate Community Care”

On March 14, 2024, Mutual of Omaha launched a digital burial insurance platform, letting seniors secure coverage online in under 10 minutes—combining speed, convenience, and peace of mind.

On February 22, 2024, Globe Life Inc. upgraded its underwriting system, delivering faster, more convenient burial insurance approvals for middle-income families.

On April 10, 2024, Foresters Financial introduced community-based burial insurance with wellness perks and grief support, blending financial protection with emotional care.

“Aging Powerhouses: Which Region Will Shape the Future of Burial Insurance?”

In 2024, North America led the Burial Insurance Market and is set to maintain its dominance. Though home to just 14.7% of the global population, its aging yet financially powerful consumers drive over 40% of global spending in insurance, wellness, and retirement. Rising life expectancy and digital adoption, from telehealth to financial apps, are accelerating demand for accessible coverage. The question is: as Europe and East Asia catch up, which region will define the future of age-focused insurance innovation?

“Burial Insurance Showdown: Will Mutual of Omaha’s Trust or Globe Life’s Reach Define the Future?”

In the U.S., the Burial Insurance Market is shaped by two giants, Mutual of Omaha and Globe Life Inc., each redefining leadership in strikingly different ways. Mutual of Omaha has built deep trust among seniors aged 45–85 with guaranteed benefits, flexible payments, and a hybrid agent-to-digital model, now strengthened by a fully digital policy platform. Globe Life, on the other hand, dominates through sheer reach, leveraging direct mail, online platforms, and call-center sales to deliver simplified, low-premium plans for middle-income families. While Omaha commands loyalty with personal service and reliability, Globe Life scales faster with accessibility and volume. Both hold strong market shares in North America, but the pressing question is, will the future of burial insurance be defined by Omaha’s trust-driven touch or Globe Life’s relentless reach?

👉 Access the full Research Description at: https://www.stellarmr.com/report/req_sample/burial-insurance-market/2804

Key Players in Burial Insurance Market

North America

Mutual of Omaha (USA)

Globe Life Inc. (USA)

Colonial Penn Life Insurance Company (USA)

AIG (American International Group) (USA)

Fidelity Life Association (USA)

Transamerica Corporation (USA)

Gerber Life Insurance Company (USA)

Foresters Financial (Canada)

Assurity Life Insurance Company (USA)

Lincoln Heritage Life Insurance Company (USA)

Europe

Allianz SE (Germany)

Aviva plc (United Kingdom)

Legal & General Group plc (United Kingdom)

AXA Group (France)

Zurich Insurance Group (Switzerland)

CNP Assurances (France)

Generali Group (Italy)

Baloise Group (Switzerland)

Asia-Pacific

Nippon Life Insurance Company (Japan)

Dai-ichi Life Holdings, Inc. (Japan)

China Life Insurance Company (China)

LIC – Life Insurance Corporation of India (India)

AIA Group Limited (Hong Kong)

TAL Life Limited (Australia)

South America

Grupo Nacional Provincial (Mexico)

SulAmérica Seguros (Brazil)

Middle East & Africa

Discovery Life (South Africa)

Old Mutual Limited (South Africa)

Related Reports:

Vulvar Cancer Market: https://www.stellarmr.com/report/vulvar-cancer-market/2812

Veterinary CRO and CDMO Market: https://www.stellarmr.com/report/veterinary-cro-and-cdmo-market/2811

Neurofibrosarcoma Treatment Market: https://www.stellarmr.com/report/Neurofibrosarcoma-Treatment-Market/2800

Pseudotumor Cerebri Market: https://www.stellarmr.com/report/Pseudotumor-Cerebri-Market/2799

Resuscitation Devices Market: https://www.stellarmr.com/report/Resuscitation-Devices-Market/2798

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Lumawant Godage

Stellar Market Research

+ +91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.